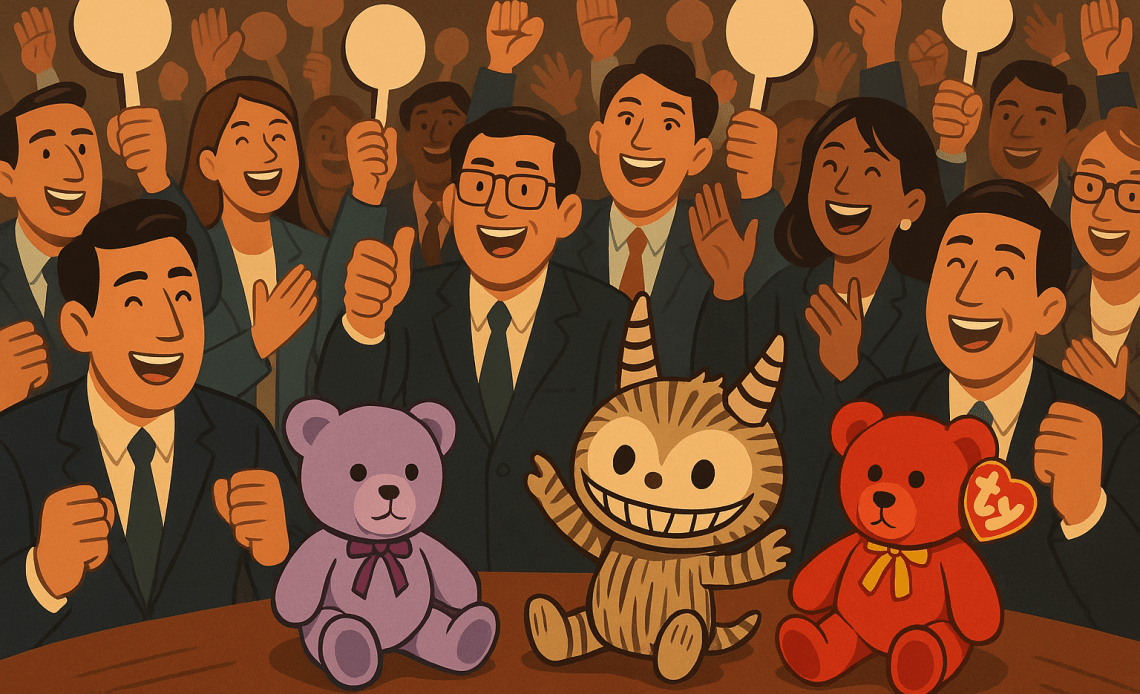

The market frenzy around Pop Mart International Group Ltd.’s wildly popular Labubu toys may be nearing its breaking point, according to a bearish analyst who likens the craze to the Beanie Babies bubble of the 1990s.

The scarcity, the hunt, the dopamine hit and the secondary market fueling Labubu’s popularity resemble the speculative cycle of Beanie Babies, said Melinda Hu, senior research analyst for Asia consumer stocks at Bernstein in Hong Kong, as quoted in a Bloomberg report.

Hu, currently the only analyst with a sell rating on Pop Mart, cautioned that the hype surrounding the company’s sharp-fanged collectable toys is at its peak.

The analyst added that she wouldn’t advise long-term investors to add the shares without fundamental changes in the company’s strategy.

Shares fall sharply after spectacular rally

The so-called golden era for Pop Mart’s stock may be fading.

The company’s Hong Kong-listed shares have fallen more than 30% from their August peak, erasing part of a 1,500% rally that began early last year.

Some of the losses were triggered by a viral incident in which an employee questioned the pricing of one of Pop Mart’s “blind-box” products during a live-streaming event, undermining confidence in the brand’s perceived exclusivity.

Pop Mart’s third-quarter results, released in late October, initially beat forecasts, but the stock slumped more than 9% on Oct. 23 after investors remained unconvinced about the company’s longer-term growth trajectory.

Growing dependence on Labubu raises concerns

Investor unease has intensified over Pop Mart’s heavy reliance on Labubu for sales momentum.

The company’s “Monsters” series, which includes the character, accounted for about 35% of total revenue in the first half of the year, up from 14% a year earlier.

“The bull–bear debate boils down to one question: can the company break free from Labubu dependency and spark growth through other IPs?” Hu added in the report, referring to Pop Mart’s stable of intellectual property brands.

So far, few signs suggest that other characters or franchises have replicated Labubu’s runaway success.

Despite Bernstein’s bearish stance, the broader analyst community remains overwhelmingly positive.

Of the 46 analysts covering Pop Mart, 42 rate it a ‘buy’, while three suggest a ‘hold,’ according to Bloomberg data.

However, traders appear increasingly sceptical. Short interest in Pop Mart’s stock climbed to 2.8% of free float as of Thursday, its highest level since April 2024, according to S&P Global data—signalling growing bets against the stock’s near-term performance.

Echoes of the Beanie Babies boom

Hu’s comparison to Beanie Babies, the 1990s-era collectable plush toys made by Ty Inc., carries a warning.

Those toys once soared in value as collectors treated them like investments—until the bubble burst in 1999, leaving most nearly worthless.

The parallel, Hu suggests, lies in the speculative psychology driving both manias: scarcity, hype, and a thriving resale market creating a feedback loop of demand detached from fundamentals.

For Pop Mart, the challenge now is whether it can turn short-term obsession into sustainable growth—or risk seeing Labubu follow Beanie Babies into collectable history.

The post Are Pop Mart’s Labubus going the Beanie Babies way? Analyst answers appeared first on Invezz