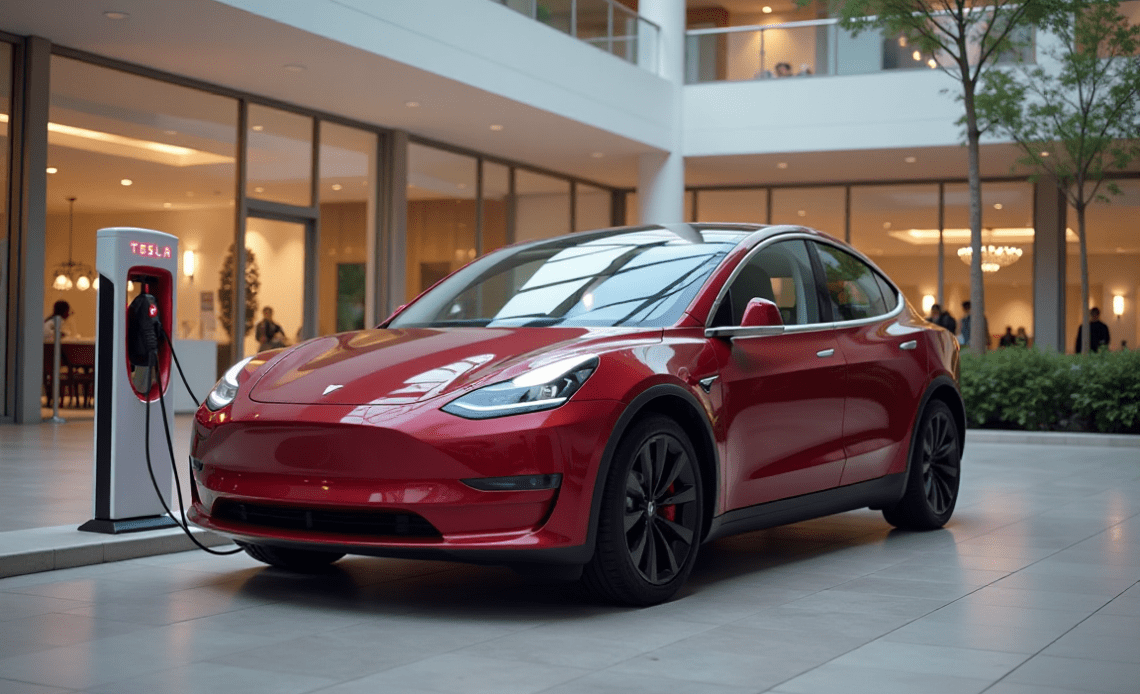

Tesla Inc (NASDAQ: TSLA) has sounded the alarm for short sellers – with chief executive Elon Musk declaring they’ll be “obliterated” once the company achieves full autonomy.

Yet behind the scenes, Tom Zhu, a senior vice president of the multinational automaker, has been quietly reducing his exposure to the EV stock, according to securities filings.

Tesla stock performance this year can be described as a tale of cities. For investors who hoped on TSLA at the start of 2025, it’s down more than 20% at writing – but for ones that invested in early April, it’s up a whopping 50%.

What could ‘obliterate’ Tesla stock short sellers?

Billionaire Elon Musk has long maintained that Tesla’s future hinges on its ability to deliver full self-driving capabilities at scale.

In a recent post on X, Musk warned TSLA short sellers that “if they don’t exit their short position before Tesla reaches autonomy at scale, they will be obliterated.”

The comment underscores Musk’s confidence in Tesla’s artificial intelligence (AI) and software roadmap, which he believes will transform the company from a carmaker into a tech powerhouse.

Autonomy, in Musk’s view, is the inflection point that will not only reshape transportation but also crush bearish bets against Tesla’s stock valuation.

For Musk, short sellers aren’t just wrong – they’re on borrowed time, especially since the EV firm has already launched its robotaxi services in Austin and confirmed plans of extending it to at least half of the US population by the end of 2025.

SVP selling TSLA shares contradict Musk’s optimism

Tesla is ramping up its robotaxi plans and has signed a multi-billion-dollar deal with Samsung to deliver on its broader AI commitments.

However, while Musk talks up Tesla’s artificial intelligence future, filings show that Tom Zhu, a senior vice president of the EV maker has been steadily cashing out.

Zhu, who played a key role in scaling TSLA’s operations in China and later took on broader global responsibilities, has sold over 82% of his stake in the Nasdaq-listed firm between 2023 and 2024.

The timing and scale of these sales – at prices ranging from $174 to $323 – have sparked concern among investors. Insider selling doesn’t always signal trouble, but when it’s this substantial, it can suggest a lack of conviction in near-term upside.

Zhu’s divestment stands in contrast to Elon Musk’s bullish stance, creating a split-screen moment for Tesla watchers: public bravado versus private repositioning.

How to play TSLA stock at current levels?

Tesla’s narrative continues to be shaped by Musk’s sweeping promises and high-stakes bets on autonomy. But the internal moves by senior leadership suggest a more cautious posture.

As the electric vehicle behemoth navigates macroeconomic headwinds, competitive pressures, and regulatory scrutiny, the divergence between Musk’s rhetoric and Zhu’s actions may reflect broader tensions within the company.

And for now, Wall Street analysts are on Zhu’s side. The consensus rating on TSLA stock currently sits at “hold” only with the mean target of about $313 indicating potential “downside” of roughly 7.0% from here.

The post Tesla warns short sellers will be ‘obliterated’, yet its SVP has trimmed stake by 82% appeared first on Invezz